TRAIL D2B - 19ème édition

Le 25 Janvier 2026, le Trail D2B sera de retour sur un événement 100% Nature. Le Trail D2B est une course à pied nature le long du littoral de la Côte d’Opale.

Particularités : le sable fuyant des dunes, le sable dur sur la plage, une météo rude à cette époque, c’est une course taillée pour les aventuriers !

Prêt.e.s pour l’expérience ?

Merci à tous pour cette édition réussie !

Merci à tous les coureurs et marcheurs pour avoir contribué au succès de cette 19ᵉ édition du Trail des 2 Baies.

Les photos de l’événement seront bientôt disponibles sur notre site internet pour revivre chaque moment.

Les résultats sont déjà en ligne.

Rendez-vous en 2027 pour célébrer ensemble la 20ᵉ édition, l’anniversaire exceptionnel du Trail des 2 Baies.

NOS AUTRES ÉVÉNEMENTS

Touquet

Bike & Run

Comme chaque année participez

à une course fun et conviviale le

samedi fin octobre sur un parcours adulte de 15km et un

parcours enfant, famille de 4km.

Touquet Raid

Pas de Calais

Fin mars / début avril

Venez vire une aventure avec nous

Raid adulte de 70km sur 1 jr

Raid Ado / Famille de 20km sur 3h

Animations gratuites enfants et grand public.

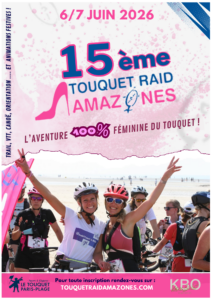

Touquet Raid

Amazones

Début juin !

Un épreuve en équipe et au coeur de la Nature accessible à toutes !

L'ASSOCIATION

L’association Touquet Raid existe depuis le 30 juillet 2009.

Son objectif : promouvoir, développer la pratique des sports comme le raid multisport, proposer des rencontres et des entraînements, participer à des évènements sportifs ; organiser des évènements ; mettre à disposition de tous les moyens de développement d’activités éducatives, sociales et récréatives.

TÉMOIGNAGES

« Rien à dire bon parcours, bonne organisation. Bravo à eux , aux organisateurs et aux bénévoles. »

« Merci pour cette nouvelle édition, on en a bavé avec ce vent mais l’organisation était top »

PHOTO DES ÉDITIONS PRÉCÉDENTES